Blog

Mobile technologies simplify many traditional banking operations, from P2P transactions and bill payments to investments and insurance contracts. Mobile banking has captured the hearts of users, especially young adults, due to its one-click payments, easy money transfers, remote account management, and embedded customer support. Yet, to enable such convenience, banking app developers have to deal with auto-inputs, blur view, in-memory data storage, and numerous compliance standards, like GDPR, PSD2, PCI DSS, and CCPA. So how do you do that? More in our blog post.

Nowadays, fintech solutions are significantly simplifying different spheres of people’s

lives. Not long ago, you must have visited a bank branch and wasted a lot of time waiting

in the queue to perform typical financial transactions. So, physical visits to traditional

banks were necessary to pay bills, transfer money, and deposit your funds.

At the same time, complex deals, including investments or signing insurance contracts, could

take several weeks or even months. But now, everything is available thanks to your banking

mobile app. According to

Statista

, 36% of smartphone owners consider using a mobile banking solution as the top activity on

their devices. Moreover, 33% report that the opportunity for mobile payment transactions is

the main reason for them to remain clients of current banking institutions.

The modern mobile banking services market offers plenty of fintech apps that can satisfy various

business requirements, from personal account management to crypto trading and stock investments.

After all, app features provided by high-quality banking software are becoming incredibly sophisticated.

Thus, we can even suppose that digital-only banking services will replace the current banking

industry.

But before it happens, let’s analyze how to build a mobile banking app properly.

Mobile banking app market

Modern customers will likely use mobile banking apps but not visit traditional branches. No doubt, they have different reasons to do that.

Why banking applications are becoming increasingly important

Banking application development is growing in popularity because today’s life and customer habits make internal mobile banking apps crucial. That is because of:

- round-the-clock access to your banking application;

- the ability to review transaction history and other financial details easily;

- remote deposits;

- strong security practices;

- the opportunity to pay bills just in one click;

- easy money transfers;

- the ability to pay off loans online.

At the same time, banking institutions can also obtain some valuable advantages from creating their own banking apps:

- reduced operating costs;

- improved customer experience;

- better return on investment (ROI);

- personalized services due to implementing AI-powered data analytics;

- added value by push notifications.

Thus, modern banks need to develop a mobile banking solution. That helps them stay competitive and attract new customers.

Target audience of mobile banking apps

Millennials and Gen Zers are the key target audience when it comes to banking app

development. These people prefer managing their financial operations using banking apps.

For instance, during a usual month, Millennials in the United States access their personal

accounts more than eight times using mobile banking apps, while non-Millennials access

only three times. Besides, in terms of credit card opening, almost 61% of Millenials do

that through a banking application.

Many experts believe that Millenials will take over the banking industry between 2025 and 2035.

On the other hand, the wealth of generations like Baby Boomers and Gen Ys will reduce. Therefore,

these two tech-savvy categories define the global course of modern banking systems. However,

only some banks have the appropriate technical background necessary for catering to them. Our

tax management system project

highlights how tailored financial solutions can meet the expectations of modern tech-savvy

users while streamlining operations for institutions.

So what will be the future of banking app development according to the mobile-first Millenials’

approach? The relevant shift will provide a more customer-oriented model, a connected environment,

frictionless operations, etc. In this case, understanding the current state of mobile banking

app development and the target audience serves as the critical starting point.

Mobile banking trends

The most popular trends in the mobile banking sector are the following:

- Neobanks VS challenger banks VS traditional banks. Among the most significant trends is that neobanks (banking app startups with no relevant license) transform into challenger banks that have it. Meanwhile, traditional banks have started buying or cooperating with both.

- Biometric security. With biometric authentication, your app development specialists can enhance the security of sensitive information and ensure the appropriate compliance with the existing financial rules. Implementing different available biometric recognition solutions allows banking mobile applications to prevent unauthorized access to customers’ accounts or devices. In addition, banking institutions can avoid identity theft, personal account hacking, and phishing.

- AI-enabled chatbots. AI chatbots serve as software solutions developed to conduct specific tasks depending on previously defined scenarios. With this conversational technology implemented into your mobile banking app, you can speed up numerous manual daily operations and reduce response times significantly.

- Machine Learning (ML). Using machine learning algorithms is becoming one of the most critical trends in developing banking mobile applications. With such advanced technology, you can analyze customer data efficiently to define their needs. Finally, by addressing clients’ issues, you will improve user experience and increase revenue.

Must-have features in 2022

Below, we have analyzed the most critical app features that serve as the core of banking software:

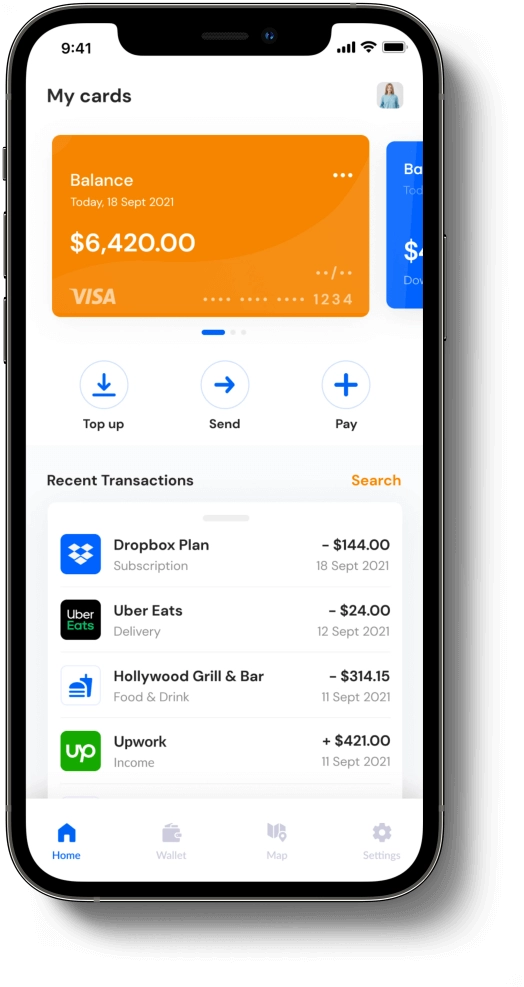

- Authentication and authorization flow. A secure mobile banking app provides users with multi-factor authentication, which is considered a sign-in option. Besides, the next important step for login is an authorization. It resolves what customers can perform and see in their online banking application. But if your company aims to deliver the best possible user experience, you have to implement biometric authentication that covers physical user metrics. They may include fingerprints, face recognition, voice, etc.

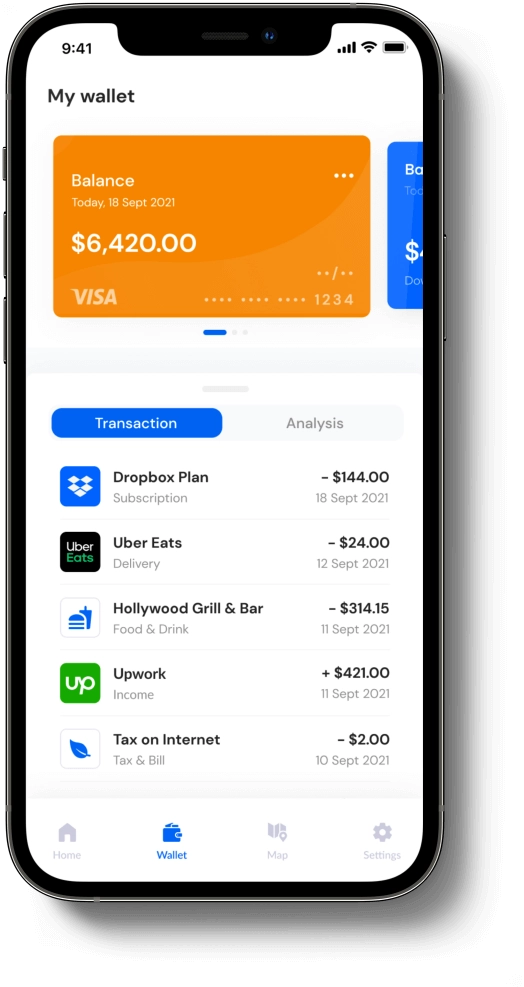

- Account management. The appropriate account management is also among the valuable features of mobile banking. It allows for seeing the account balance, tracking spending, recording the transaction history, and analyzing habits. Also, your online banking service can offer users to establish saving goals, create investment plans, and make their regular mobile payments automated.

- Customer support. The best mobile banking app solutions ensure that their users can contact customer support representatives round-the-clock to address problems. For instance, your company can improve the user experience by providing your mobile banking application with an AI-based chatbot.

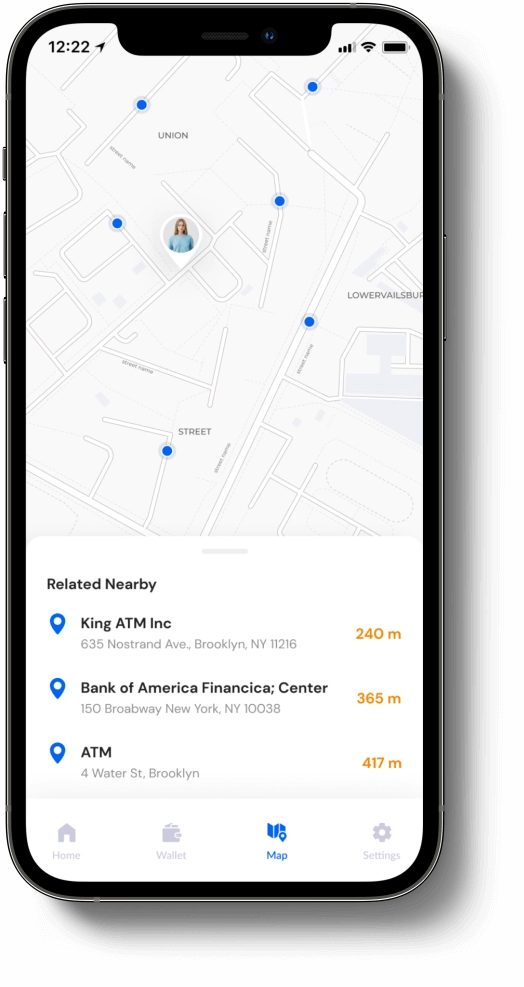

- ATM/bank branch locator. The ability to search for ATMs and branch locations is among the most helpful mobile banking app features. That can ease your clients’ lives significantly. Also, you should provide the information about banking services you offer, operating hours, and routes.

- Secure payment & transactions. Your organization has to ensure the appropriate security of each in-app payment and transaction processed by your mobile banking application. They must be available anytime, despite the customer’s location.

- Push notifications. Sending relevant alerts regarding account updates is also among the important mobile banking app features. That allows your clients to stay informed. However, you should push notifications wisely since customers can lose your messages in the typical data noise. After all, they may get frustrated because of this when using your online banking system.

- QR code payments. Implementing QR codes for paying is one of the app features that make it multifunctional. So, users will highly appreciate the opportunity to buy tickets or make purchases thanks to QR code payments. Also, a good option is to provide the Google Pay function.

Advanced mobile banking app features

To drive innovation and stay ahead of other competitors in the mobile banking market, you can add some of the following mobile banking app features to your solution:

- Expense trackers. Controlling the money situation is vital for many online banking users. So, you should help customers stick to budgets and encourage them to save more funds. To do that, you can split periods using weekly, monthly, quarterly, or yearly options.

- Cashback services. Cashback is among the banking app features that are becoming increasingly important, especially when considering the growth of e-Commerce. Such a function can promote users of mobile banking solutions to make more in-app payments. Besides, cashback can serve as a solid background to build the loyalty program of your financial institution.

- Personalized offers. With specific offers and discounts, organizations can build excellent personal relationships with their mobile banking app users. Also, these users will value and trust your brand. That allows your banking software to drive more clients and increase revenue.

- Unique services. Successful mobile banking development may cover many other non-obvious banking operations. They include purchasing tickets online, car rent, table reservation, order delivery, etc.

- App for wearables. No doubt, you should consider the potential of wearables when developing mobile apps. They allow for displaying bank account information, receiving alerts, and making payments or other transactions.

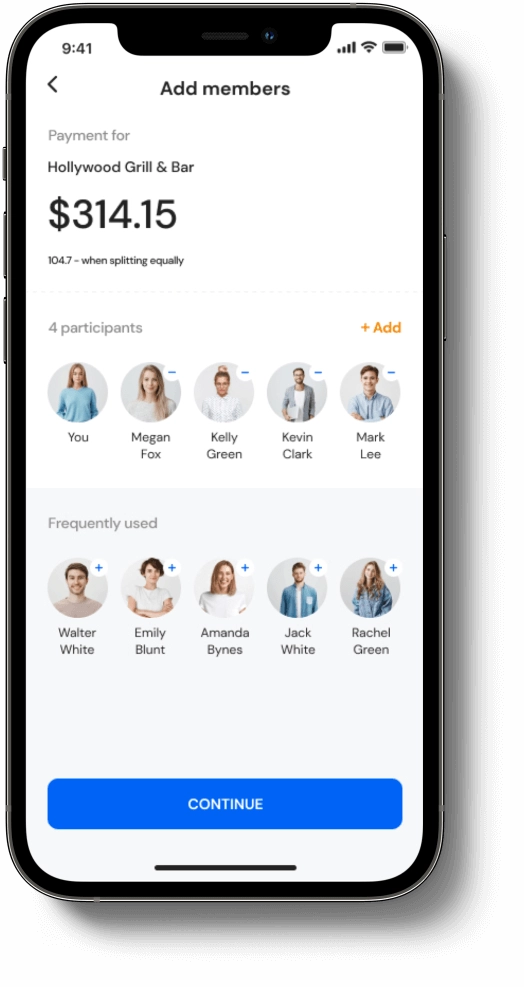

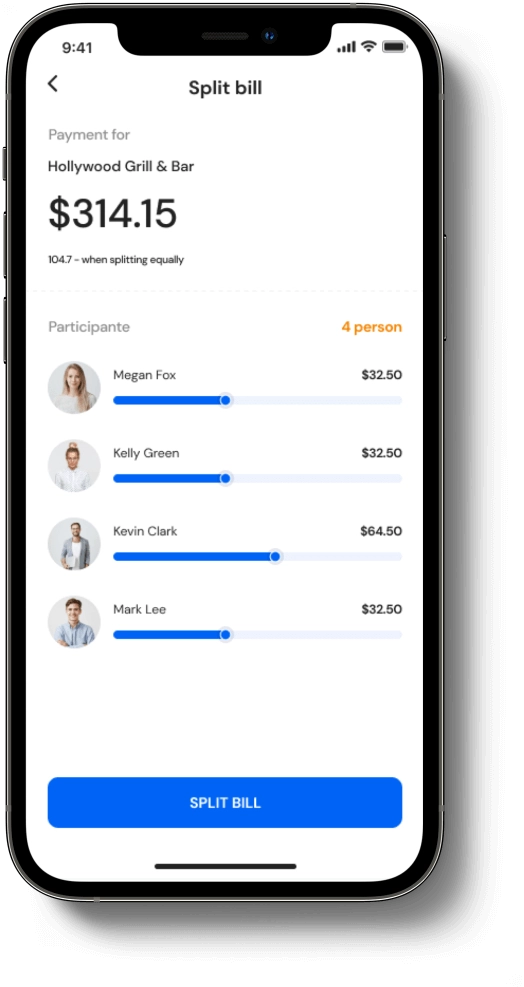

- Bill-splitting. It is becoming one of the most popular mobile banking app features. Bill-splitting enables users to divide bills and assign each individual his cost.

- Chatbot/voice assistant. Your company can implement voice-powered online banking chatbots that will provide users with the necessary information and serve for transaction purposes. After all, with this technology, your mobile banking app customers will get a compelling, advanced user experience.

- Blockchain. This tech trend is not only associated with cryptocurrencies. For example, the banking sector utilizes blockchain since it improves speed and accuracy and provides top-notch security.

- Cardless ATM access. You can enable your banking app clients to withdraw cash, although they may not have their cards. In this case, your mobile app development solution will require account verification using text messages or in-app calls.

Of course, the presence of different app features is the first criteria for all clients when they decide whether to use your banking software. Thus, you have to consider that during your mobile banking application development.

Main banking app development challenges

If your organization wants to develop a secure mobile banking app, your product owners and software engineers may face some challenges typical for the fintech development process.

Tech challenges

Mobile banking app development comes with many technical nuances that engineers should remember:

- Auto-inputs. App development specialists have to disable auto-inputs in each UI field where users can enter different types of information. That allows your company to protect your banking app from third-party ransomware attacks extracting personal data from the banking software.

- Blur view. The blur view takes place when customers switch between different apps. This feature of mobile apps provides additional security and protects users’ sensitive data. So, strangers have no chance to see it. Thanks to the implemented blur effect, the last mobile banking app screen is not visible.

- In-memory data storage type. Banking software requires a specific approach to storing information, also known as in-memory type. App development professionals utilize this type since it ensures that all downloaded or obtained information is cleared after deleting your banking app. After all, when implementing in-memory databases, the client information cannot be “physically” collected from their devices. They can be hacked, but cybercriminals will not get the data.

Tech challenges

Of course, mobile banking app development solutions have to be compliant with multiple laws, standards, and rules. The most critical of them include:

- GDPR. The General Data Protection Regulation (GDPR) has established the rules to protect personal data in the European Union (EU).

- PSD2. The New Payment Services Directive (PSD2) contributes to developing innovative online and mobile banking payments, making them more secure, and improving customer protection within the EU and the European Economic Area (EEA).

- PCI DSS. Payment Card Industry Data Security Standard (PCI DSS) covers maintaining, evolving, and promoting Payment Card Industry standards to ensure cardholder information safety around the world.

- CCPA. The California Consumer Privacy Act (CCPA) intends to provide residents of California, USA, with the appropriate privacy rights and customer protection. That gives more control related to the personal data collected by businesses.

So after finishing the theoretical part, let’s analyze the mobile banking app development process.

Mobile banking development steps

Here, we will describe how to start banking app development and build mobile apps that will ensure millions of downloads. So, we have created a list of the critical steps your company can implement in a relevant roadmap.

Conduct research and create a plan

Such a preliminary phase is crucial, and your business should not skip it at any cost.

Thus, the first step requires conducting market research. In this case, your business

analyst can define your main competitors, analyze different mobile banking apps available

on the market, and understand what features make particular solutions popular among

people. If your organization fails to do that, you will go the wrong way.

After getting the research results, you should define the target audience of your mobile banking

app. It can cover corporate customers, families, individual clients, or institutions. Understanding

your audience allows you to identify the existing pain points necessary to sketch an app toolkit.

During this phase, you have to create a detailed plan to develop a mobile banking solution.

That also involves expenditure projections that will serve as the basis for your budget.

Build a prototype

All fintech or mobile banking apps start with a simple idea. To bring into life, your

company has to build a relevant sketch or prototype that will explain in general terms the

future structure and order of different design components, visuals, and content. For

instance, you can start using low-fidelity wireframing. That allows for sketching a home

screen, clients’ accounts, personal dashboards, etc.

Traditionally, wireframes include boxes, lines, and texts. Besides, companies make them using

the white and black color scheme. Your organization may utilize a mobile banking app wireframe

for validation of your concept and collection of early feedback.

After that, you can transform wireframes into hi-fi prototypes that cover the product’s graphic

presentation, layout, interface elements, color scheme, and relevant micro-interactions. As

in the case of wireframes, you should use the prototype of your banking app development solution

to represent its toolkit, test functions, and user interface. Lastly, you can provide default

texts, placeholders, or test information. That will allow customers to understand how such

banking apps work.

Create a graphic design

The particular part of banking app development requires some hard work. That is because

the appropriate design of mobile apps makes them recognizable.

Of course, there are numerous tactics to create an excellent design for your banking application.

Below, you can find a short list containing the most critical recommendations:

- ensure that typography, icons, images, color scheme, buttons, and various forms of your mobile banking app fit the corporate style of your organization;

- the navigation must refer to your app’s logical architecture; each design component, including buttons, links, forms, and icons, have to be sufficiently clear and comprehensive;

- select colors, images, and videos evoking great emotions and feelings;

- pay attention to cultural differences if you aim to run a business globally;

- follow the existing iOS and Android standards;

- the icon of your banking app development solution must be unique;

- consider some extra bells and whistles, such as branded sticker packs for chats.

Select a technology stack

When selecting a technology stack for your banking application, there is a need to focus on four critical areas:

- front-end development

- back-end development

- cross-platform app development frameworks

- other important prerequisites, like robustness and security.

In addition, your company should create a checklist covering the following aspects:

- the scope, complexity, and scalability of your banking app development project;

- the number of professionals and how competent they are;

- required tools and software;

- third-party solutions;

- documents and specifications.

Today, there are various mobile apps, including native, hybrid, and cross-platform. All

types have their own advantages and disadvantages, along with specific features.

For instance, native apps are probably the most robust. They are well-known for their high

performance, which makes them a perfect solution for established businesses. These apps enable

tech specialists to implement native functionality of relevant iOS and Android devices with

no need to utilize different third-party APIs.

At the same time, developers create hybrid applications using web technologies. They build

such apps for various platforms because of a unified code base. Since hybrid apps are based

on HTML, CSS, and JavaScript, they may serve as progressive web applications. After all, there

are multiple frameworks used to build hybrid apps from scratch. They include Ionic Framework,

Xamarin, and Phone Gap.

Develop and test

Your company can choose one of the two paths of developing banking apps – use an app

builder or hire a dedicated software development team. The “Do IT Yourself” approach requires you to utilize an app builder, select a

template, configure the settings, implement the necessary layout, and obtain a ready-made

application in just a few minutes.

Such app builders are perfect if you have no tech skills, enough time, or financial resources

to create an appropriate mobile banking application. Besides, the support team behind a relevant

maker will help your company maintain the app and offer great analytics tools.

On the other hand, if your organization has a brand-new idea that requires custom software

development, you should hire a team of experienced specialists. Not surprisingly, this approach

is more costly and lengthy. However, it enables companies to build banking apps with a well-thought-out

architecture and a user-friendly interface and select the most suitable technology stack.

Market the app and receive feedback

Google Play Market, Apple App Store, and Microsoft Store are among the most popular

marketplaces. Each of them has various requirements for mobile apps. Thus, your company

has to follow them to avoid potential rejection.

If your organization utilizes an app builder, you will be sure that your banking application

adheres to all the required standards by default. But when you create banking apps on your

own, there is a need to control the particular process. That will save time on further improvements

or changes. After your product appears on Google Play Store, iTunes, or Microsoft Store, you

should wait for first ratings and feedback.

Make improvements and updates

Launching your mobile banking app means the beginning. After that, your company needs to

collect valuable feedback and understand how to improve and update its product. Here, you

should ask your customers for reviews, contact relevant review sources, or ask different

influences to test your application.

For example, if your target audience is Apple users, your company can submit a specific application

to Apple’s editorial team. Then, they will provide you with an expert review. Also, you can

apply your banking application to Top Apps lists or other different awards.

After receiving the feedback, you may identify the weak and strong sides of your mobile app

and create a plan to improve them.

Best technology stack for mobile banking app development

Selecting the right technology stack is an essential step in mobile banking application development. Below, there are some widely used tools and technologies you can utilize for your fintech app development.

Native app development

Of course, your company can build a mobile application solely for a specific platform – iOS or Android. In this case, your option is native app development. When creating iOS-based native apps, your mobile banking application development team can use the following technology stack: Swift, XCode, and iOS SDK. On the other hand, when building Android-based native apps, your app development process should depend on tools like Java, Kotlin, Android Studio, and Android SDK.

Cross-platform app development

Many mobile banking development companies consider cross-platform app development the best possible approach. That is because it enables online and mobile banking engineers to implement a single code base for various operating systems. When choosing the technology stack, React Native, Flutter, and Xamarin can assist you in building cross-platform apps.

Hybrid app development

Depending on the name, hybrid mobile banking applications combine native app development and web development . Software companies usually build such mobile apps with HTML5, CSS, JavaScript, and PhoneGap. Also, they run these internet banking solutions using a specific container. That enables mobile banking app developers to embed such solutions in native apps.

To sum up

The modern online banking industry is quite specific. Therefore, developing an efficient

mobile banking application requires relevant efforts. But at the same time, your

organization can develop a high-quality banking app if you can meet previously defined

deadlines, create a realistic budget plan, and build an experienced mobile banking

development team. After all, a successful mobile banking app is one that delivers a

memorable financial experience.

So, how to make a mobile banking app that provides value?

- Addressing security concerns should become your top priority. Your customers will not appreciate an outstanding user experience if cybercriminals can hack their bank accounts easily.

- With personal financing options, your mobile banking app obtains extra value. If customers can track expenditures and plan their own budgets, they will not utilize other fintech apps that offer such critical features of mobile banking.

- The appropriate customer support is the factor that ensures secure mobile banking. Thus, you should provide your clients to contact you via preferred messengers and make support agents less formal and helpful.